Anti-tumor small molecule targeted drug growth rate of more than 50%,100 + billion market competition

Release time:

2019-07-09

Small molecule targeted drugs grow by more than 50%

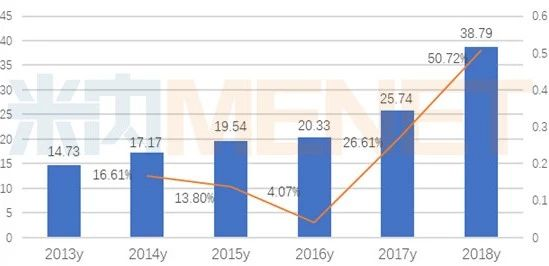

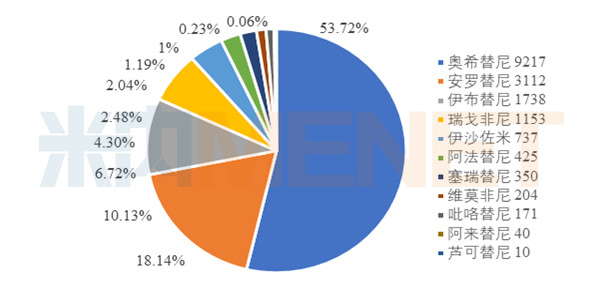

According to data from the Intranet, in 2018, the amount of small molecule targeted drugs used in public hospitals in key provinces and cities in China reached 3.879 billion billion yuan, an increase of 50.72 percent over the previous year. There are 25 drugs in clinical use of anti-tumor small molecule targeting agents.

After 2017, 11 new small molecule targeted drugs were listed. Among them, the varieties listed in 2017 are AstraZeneca's osimertinib tablets, Janssen's ibrisinib capsules, Bayer's regofenib tablets, Boehringer Ingelheim's afatinib tablets, and Novartis's lukotinib tablets.

In 2018, the varieties listed were Anlotinib capsules from Zhengda Tianqing Pharmaceuticals, Pyritinib tablets from Jiangsu Hengrui Pharmaceuticals, Seritinib capsules from Novartis, Ishazomib capsules from Takeda, and Vermofenib tablets and Aletinib capsules from Roche. In 2018, the clinical use of these 11 drugs in public hospitals in key provinces and cities in China totaled 171.57 million billion yuan, with a year-on-year growth rate of 1707.9 percent, showing a rapid growth trend.

Sales of terminal small molecule targeted drugs in public hospitals in key provinces and cities (unit: billion yuan)

Sales of newly listed small molecule targeted drugs in public hospitals in key provinces and cities in 2018 (unit: 10,000 yuan)

TOP5 Small Molecule Targeted Drugs Grow 46.89 Percent

According to intranet data, TOP5 varieties of small molecule targeted drugs clinically used in public hospitals in key provinces and cities in China in 2018 are imatinib tablets and capsules, gefitinib tablets, bortezomib for injection, icotinib tablets and sorafenib tablets. The amount of medication was 2.819 billion yuan, up 46.89 from the previous year. It accounts for 72.67 percent of the total market for 25 drugs with anti-tumor small molecule targeted agents.

Gefitinib up 75.56 percent year-on-year

Gefitinib is a selective epidermal growth factor receptor (EGFR) tyrosine kinase inhibitor. In February 2005, Gefitinib, a small molecule targeted drug developed by AstraZeneca, entered the Chinese market under the trade name of Iressa. At present, gefitinib is a Class B variety included in the national health insurance list. It is the first targeted drug for the treatment of non-small cell lung cancer. It is used for the first-line treatment of patients with locally advanced or metastatic non-small cell lung cancer with sensitive mutations in the epidermal growth factor receptor gene, and is also suitable for the treatment of patients with locally advanced or metastatic non-small cell lung cancer who have received chemotherapy before.

Anti-tumor targeted drugs have great differences in sensitive populations. In particular, gefitinib shows a certain activity against EGFR mutations in lung cancer patients of different races, and its efficacy exceeds that of commonly used first-line chemotherapy. Studies have shown that Iressa has a significant life-prolonging effect on people of Eastern race or who have never smoked. It has been included and recommend in the clinical guidelines for lung cancer in China in 2005.

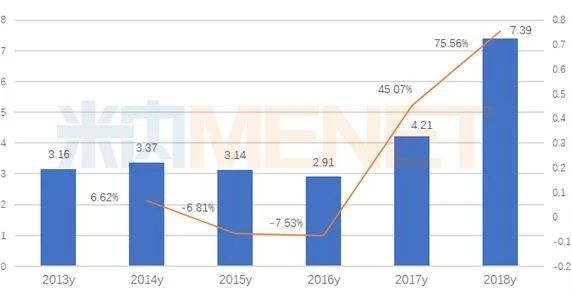

According to data from the Intranet, in 2018, the gefitinib market for public hospitals in key provinces and cities in China was 0.739 billion billion yuan, a year-on-year growth rate of 75.56 percent. AstraZeneca's Iressa accounts for 78.11 percent, and Qilu Pharmaceutical (Hainan)'s Irekor accounts for 21.89 percent. Domestic gefitinib has exceeded the 2 billion scale.

Sales of terminal gefitinib in public hospitals in key provinces and cities (unit: billion yuan)

Gefitinib through the National Health Planning Commission's first batch of drug price negotiations, into the new health insurance catalog, has reached the results of the reduction of the amount. After the first round of 4+7-band procurement was carried out, the price of Erek (250mg * 10 tablets) of Qilu Pharmaceutical (Hainan) was adjusted to 498 yuan. In the 4+7 collection, AstraZeneca's Iressa (250mg * 10 tablets) was selected from 547 yuan, a decrease of 76%.

On May 20, 2019, gefitinib tablets developed by Zhengda Tianqing Pharmaceutical Co., Ltd. have been approved by the State Drug Administration for drug registration. Gefitinib will form a three-legged pattern of AstraZeneca, Qilu Pharmaceuticals and Zhengda Tianqing, and gefitinib tablets will become the leader in domestic lung cancer targeted drugs in 2019.

Icotinib up 54.27 percent

Ikotinib is the first small molecule targeted anti-tumor drug with completely independent intellectual property rights in China developed by Zhejiang Beida Pharmaceutical Co., Ltd., and its trade name is "Kemena". It is the same generation of tyrosine kinase inhibitors as AstraZeneca's gefitinib and Roche's erlotinib, and is used for advanced non-small cell lung cancer.

Iketinib has Chinese, American and international patents. It is similar to gefitinib and erlotinib in terms of chemical structure, molecular mechanism of action, and efficacy, but it has better safety and has been highly praised by international clinical oncologists. It has been included in the national class B medical insurance list. The efficacy of icotinib on advanced NSCLC is comparable to gefitinib, and the safety is better than gefitinib, which is an important local variety in the non-small cell lung cancer market. In the promotion of domestic "Tinib class" clinical drugs, gradually broke the monopoly of western drugs market situation.

In May 2016, after the results of the national drug price negotiations were announced, the price of icotinib was reduced by 54%. According to the company's data, the volume effect brought by the price reduction of icotinib is obvious, and the sales volume in 2016 and 2017 have increased significantly, basically making up for the impact of the price reduction. In 2018, Betta Pharmaceuticals focused on promoting the landing of local health insurance policies and completing the relevant policy convergence for the implementation of the Class B catalogue of health insurance. In addition to consolidating the hospital market in big cities, it will expand to the 2. third-tier city hospital market. According to data from the Intranet, the market for icotinib in public hospitals in key provinces and cities in China was 0.43 billion yuan in 2018, with a year-on-year growth rate of 54.27.

Sales of terminal ectini in public hospitals in key provinces and cities (unit: billion yuan)

Imatinib domestic scale of 3 billion

Novartis's imatinib (Imatinib) entered the Chinese market in 2002 under the trade name Gleevec. It is used to treat chronic myeloid leukemia patients in the blast phase, accelerated phase or chronic phase after α-interferon treatment failure. Patients with malignant gastrointestinal stromal tumors that cannot be surgically removed or metastasized. In 2013, Jiangsu Haosen Pharmaceutical Group Imatinib tablets listed, trade name Xinwei. In 2014, Zhengda Tianqing Pharmaceutical Group Imatinib capsules were listed, the commodity name Gennico.

According to data from the Intranet, the imatinib market for public hospitals in key provinces and cities in China was 0.831 billion billion yuan in 2018, with a year-on-year growth rate of 17.18. Novartis's Gleevec accounted for 79.54 percent, showing a downward trend year by year, Jiangsu Hausen's Xinwei accounted for 11.81 percent, Zhengda Tianqing's Gnyke accounted for 7.98 percent, stone medicine Europe's Nolinin accounted for 0.67 percent.

Sales of terminal imatinib in public hospitals in key provinces and cities (unit: billion yuan)

Sorafenib growth rate 93.14 percent

In recent years, targeted drugs have made great progress in the treatment of advanced renal cancer, showing a competitive situation in the combination Everolimus of Pfizer's Sunitinib, Bayer's Sorafenib, Novartis's Everolimus, Pfizer's axitinib and Japanese Eisai's Lenvatinib. In 2018, global targeted therapy drugs for renal cell carcinoma reached $12 billion billion, an increase of 20% over the previous year.

According to the data of Mi Intranet, the sorafenib market of public hospitals in key provinces and cities in China was 0.361 billion billion yuan in 2018, with a year-on-year growth rate of 93.14. In recent years, Pfizer's small molecule targeted formulations of sunitinib and axitinib have been listed in China for the treatment of kidney cancer, which has intensified the competition in the kidney cancer market.

Sales of terminal sorafenib in public hospitals in key provinces and cities (unit: billion yuan)

Sorafenib (Sorafenib) is a new multi-targeted oral drug developed by Bayer Pharmaceuticals and Onyx. In December 2005, the United States FDA approved the listing, trade name Nexavar. Sorafenib is the first multi-target targeted therapeutic drug approved for clinical use in the world, which can significantly inhibit tumor cell proliferation and tumor angiogenesis. In September 2006, Bayer's sorafenib was approved by the State Food and Drug Administration to be registered and listed in China under the trade name of dojimei.

Renal cell carcinoma is a common malignant tumor in human, and it is also the second only to bladder cancer in the malignant tumor of urinary system, and it is increasing year by year. Surgery is the main treatment for renal cell carcinoma, but the recurrence rate and metastasis rate of high-risk patients are relatively high, and the prognosis is poor. However, the exploration of postoperative hormone, chemotherapy, immune adjuvant therapy and postoperative adjuvant radiotherapy has not obtained a positive effect. The efficacy of sorafenib in the treatment of Chinese patients with advanced renal cell carcinoma was significantly better than that of European and American populations.

It is suitable for inoperable or distant metastatic liver cancer, metastatic renal cell carcinoma, locally recurrent or metastatic, and gradually differentiated thyroid tumors. It is the only new drug approved by FDA for the treatment of renal cancer in the past 10 years. This product is also the only small molecule targeted drug that can be used to treat liver cancer, and it also has certain application prospects in clinical applications such as non-small cell lung cancer and breast cancer.

Market Prospect of Anti-tumor Small Molecule Targeted Drugs

According to information released by the FDA Drug Evaluation and Research Center of the United States, 60 anti-tumor small molecule targeted drugs have been listed after the FGFR3 or FGFR2 mutation locally advanced metastatic bladder cancer small molecule targeted drug erdatinib (Erdafitinib,Balversa) approved by the FDA in the first half of 2019.

After entering the 21st century, new small molecule targeted preparations are drugs with unique mechanisms of action that have stood out in the past 20 years. Since the success of the drug Gleevec represented by tyrosine kinase inhibitors (Tinib), the research and development pipeline New products have entered the clinic one after another, and the varieties after the market have achieved excellent sales performance.

Domestic research and development pipeline data, domestic research and development of tinib drugs as many as dozens of varieties. There are drugs listed in the country, there are also drugs not listed in the country. The main research and development enterprises are Qilu Pharmaceutical, Shanghai Hutchison Whampoa Pharmaceutical, Kelun Pharmaceutical, Jiangsu Hengrui Pharmaceutical, Jiangsu Haosen Pharmaceutical, Jiangsu Zhengda Tianqing Pharmaceutical, Jiangsu Xiansheng, Harbin Yuheng Pharmaceutical, Shanghai Pharmaceutical Research Institute, Chinese Academy of Sciences, etc. In the future, small molecule targeted drugs are full of more market competition and price competition, and are also expected to bring new therapeutic mechanisms to the pharmaceutical market.