21.08 percent down! The 43.4 billion market was hit by a double blow, and the collection and negotiation varieties were traded for quantity.

Release time:

2020-07-15

A sudden new crown epidemic in 2020 has changed the way people live. As a result of the epidemic, the number of regular patients seeking medical treatment and hospital prescriptions decreased significantly, and the demand for non-epidemic drugs and medical supplies decreased. In addition, 4 7 collection and expansion of collection, health insurance negotiations and national key monitoring of rational drug use and other policies on the ground, resulting in a significant decline in the amount of drug use in China's medical institutions in the first quarter of 2020.

Drug sales in key provincial and municipal public hospitals fell by 21.08 in the first quarter of 2020.

The first quarter of 2020 is the implementation period of policies such as "4+7" collection and "4+7" expansion collection, 97 medical insurance negotiation varieties (including chemical drugs and proprietary Chinese medicines) and 17 anti-tumor varieties of medical insurance negotiation varieties and the national key monitoring of rational drug use drug catalogues, which have had a profound impact on the drug use pattern of Chinese medical institutions. Sales of chemical drugs in public hospitals in more than 20 key provinces and cities in China were 43.4 billion billion yuan in the first quarter of 2020, down 21.08 percent compared to the first quarter of 2019 and 24.51 percent compared to the fourth quarter of 2019, according to Mainet data.

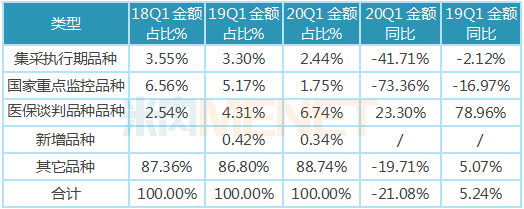

The combined sales of the 28 collection execution period varieties accounted for only 2.44 percent of the total chemical drug sales, and the growth rate of their sales amount declined significantly, down 41.71 percent compared to the first quarter of 2019, due to the significant decline in the bid price.

Under the impact of the epidemic, the sales amount of the 20 varieties (43 drugs in total) in the national key monitoring drug list showed a precipitous decline, down 73.36 percent compared to the first quarter of 2019, and their share of sales also fell from 6.56 percent in the first quarter of 2018 to 1.75 percent in the first quarter of 2020. Most of these varieties are composed of auxiliary drugs and nutritional drugs with low clinical value, and their market share will still be greatly reduced in the future.

Market demand for the 89 health care negotiation varieties remains strong, and their sales have maintained a rapid growth momentum in the face of the epidemic, up 23.30 percent compared to the first quarter of 2019, and the share of sales has risen from 2.54 percent in the first quarter of 2018 to 6.74 percent in the first quarter of 2020. Most of these varieties are newly listed in recent years and have high clinical value, clinical necessity, but the price is also relatively high drugs, after the health insurance negotiations, the price has dropped significantly, improve the accessibility of drugs, ushered in the opportunity for the development of varieties.

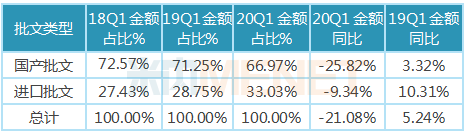

Table of the percentage and growth of different types of public hospitals in key provinces and cities in China in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

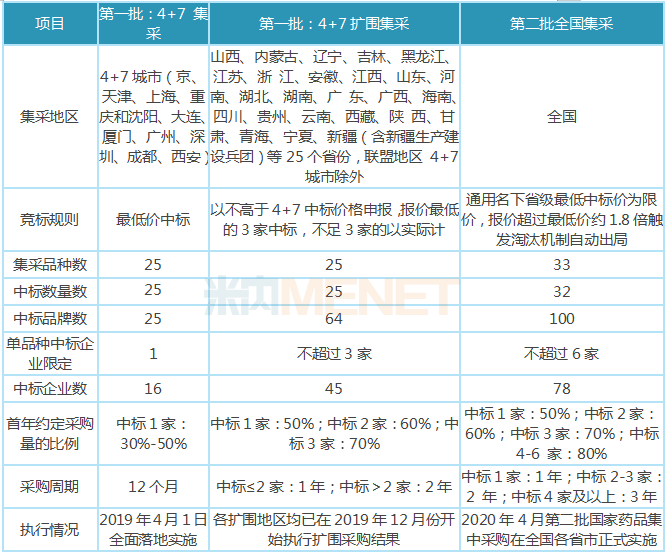

Sales of 28 centralized varieties increased by 64.67, while sales fell by 41.71

In 2019, the reform of the medical and health system with the centralized procurement and use of drugs as a breakthrough has been deepening, and price reduction has become the main theme of this round of reform. Under the drastic measures of the National Health Insurance Administration and relevant ministries and commissions, the "4+7" centralized procurement pilot work has been carried out smoothly, and 25 varieties will be fully implemented on April 1, 2019. In September 2019, the "4+7" band procurement will be expanded nationwide, with the influx of original research enterprises and Indian generic drugs, and the price war is becoming more intense. All the expanded regions have already started to implement the expanded procurement results in December 2019; in November 2019, the second round of bulk procurement was successfully launched, with an average price drop of 53%. After the stagnation period of policy promotion and release in February and March 2020, the speed of policy promotion resumed. As of April 30, all provinces and cities in the country except Hubei Province have issued documents and officially implemented the results of the second batch of national centralized procurement. The overall process has not been significantly affected by the epidemic. The third batch of national drug collection is likely to start in the second half of 2020, the collection varieties will also be gradually expanded from oral solid preparations to injections, from consistency evaluation varieties to non-evaluated varieties. It is expected that the collection in 2020 will remain one of the core events of the pharmaceutical industry throughout the year.

It is foreseeable that in the next few years, the collection will be normalized. With the increase of collection varieties, the internal structure of the pharmaceutical industry will continue to adjust. The profit model of China's pharmaceutical industry based on public relations and sales will gradually be ended. Generic drug companies will slowly enter the era of low profit margins that rely on scale and cost to win. The cost and quality control capabilities of companies will become fierce competition in the generic drug market. The key to winning.

Details of the first and second batches of procurement with quantity

Note: The data comes from Shanghai Sunshine Pharmaceutical Procurement Network, which is summarized and sorted by the punctuation information network.

In the first quarter of 2020, in the "collection" variety implementation period for the "4+7 collection" and "4+7 expansion collection" varieties, of which a total of 28 chemical varieties, the total sales amount fell 41.71 percent year-on-year, far lower than the overall growth rate of the entire chemical -21.08 percent, but its total sales volume growth rate has risen sharply, up 64.67 percent year-on-year, it can be seen that the "4 7" pilot and expansion have realized the effective exploration of deepening the centralized drug procurement system, realized the price for quantity, the effective return of drug prices to a reasonable level, and the comprehensive reform has achieved remarkable results.

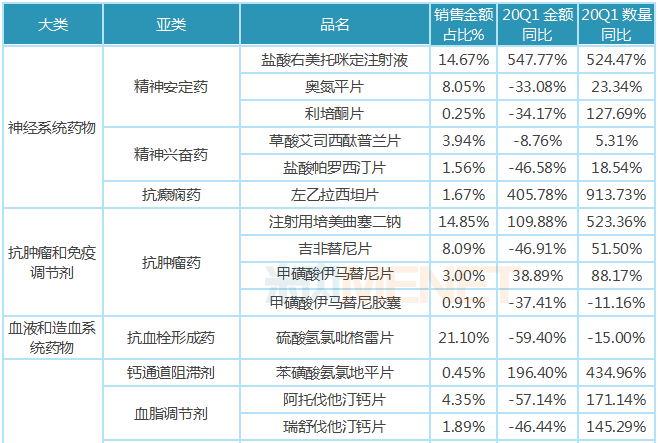

The "collection" varieties in the implementation period of the first quarter of 2020 are mainly distributed in 8 major systems including nervous system drugs, anti-tumor and immunomodulators, blood and hematopoietic system drugs, cardiovascular system drugs, systemic anti-infective drugs, and musculoskeletal system. Medication, mainly concentrated in the field of medication for major and chronic diseases such as neurostat drugs, anti-tumor drugs, anti-thrombotic drugs, and blood lipid regulating drugs.

From different varieties, the year-on-year growth rate of sales volume of all varieties is significantly higher than the year-on-year growth rate of sales amount. Among the three injection varieties, the sales amount and sales volume of dexmedetomidine hydrochloride injection and pemetrexed disodium for injection increased significantly, and the sales amount and sales volume of flurbiprofen axetil injection decreased by a relatively large margin; among the oral preparation varieties, levetiracetam tablets, imatinib mesylate tablets, amlodipine besylate tablets, losartan potassium tablets, erbesartan tablets, montmorillonite powder and other six varieties increased significantly. The varieties with a decline of more than 40% in sales amount are mainly used for chronic diseases, including paroxetine hydrochloride tablets, gefitinib tablets, clopidogrel hydrogen sulfate tablets, atorvastatin calcium tablets, rosuvastatin calcium tablets, irbesartan hydrochlorothiazide tablets, fosinopril sodium tablets, lisinopril tablets, entecavir dispersible tablets, tenofovir fumarate dipivoxil tablets, entate sodium tablets, entate tablets, entate tablets, entate sodium tablets, and cefurosemil tablets.

Table of growth in public hospitals in key provinces and cities in China in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

The drug structure has been continuously optimized, and the sales of key monitored drugs in 41 countries have fallen by more than 50%.

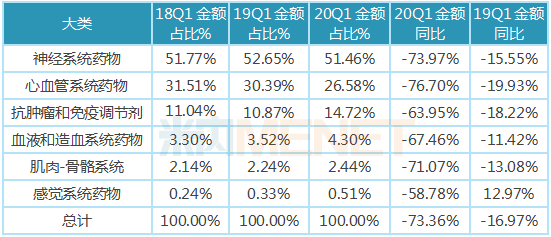

Since 2015, the state has issued a series of policies to promote the implementation of the list of rational drug use drugs. "Key monitoring of rational drug use drug list" is an important guarantee measure to strengthen the clinical application management of auxiliary drugs in medical institutions, standardize the clinical application behavior of auxiliary drugs, improve the level of rational drug use, and safeguard the health rights and interests of the people. On July 1, 2019, the Medical Administration and Hospital Authority of the National Health Commission announced the first batch of national key monitoring and rational drug use drug catalogues, with a total of 20 generic varieties, involving 43 drugs, distributed in 6 major areas, including nervous system drugs, cardiovascular system drugs, anti-tumor and immune modulators.

Among the 43 national key monitoring drugs for rational drug use, nervous system drugs have the largest variety, with a total of 25, accounting for 51.46 percent of the total sales amount, followed by cardiovascular system drugs, with a total of 6 drugs, accounting for 26.58 percent of the total sales amount. four are anti-tumor and immunomodulators, accounting for 14.72 percent of the total sales amount, while the remaining categories of drugs are relatively small, the proportion of sales amount is less than 5%.

The sales of 43 drugs in the first quarter of 2020 showed a cliff-like decline, of which 37 drugs fell by more than 60%, and 41 drugs fell by more than 50%. In the future, the national key monitoring drug list will continue to adjust and improve, the drug structure of medical institutions will continue to optimize, and the market share of therapeutic drugs will be further increased.

Table of growth in the broad categories of national key monitored rational drug catalogue of public hospitals in key provinces and cities of China in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

89 countries talk about varieties of sales amount increased by 23.30, sales volume increased by 122.44

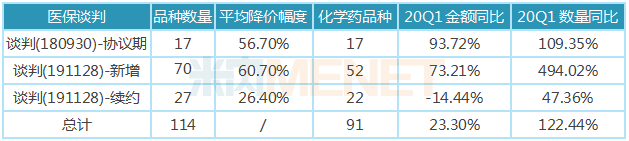

Negotiating price reduction is the only way for innovative drugs to enter the national medical insurance catalog. Since 2016, relevant national departments have led four drug medical insurance negotiations. On September 30, 2018, the National Medical Security Administration issued the ''About 17 anti-cancer drugs Notice on Incorporating Class B of the National Basic Medical Insurance, Work Injury Insurance and Maternity Insurance Drug Catalog, seventeen drugs, including azacitidine, were negotiated into the category B scope of the National Drug catalogue of basic Medical Insurance, Industrial injury Insurance and Maternity Insurance (2017 Edition), with an average price drop of 56.7. The 17 varieties negotiated by the state are all tumor treatment drugs that are clinically necessary, effective, and urgently needed by insured persons, involving non-small cell lung cancer, kidney cancer, colorectal cancer, melanoma, lymphoma and other cancer types. The prescribed payment standard is valid until November 30, 2020; on December 18, 2019, after experiencing "soul bargaining, the National Health Insurance Bureau and the National Health and Health Commission jointly issued the" Notice on Doing a Good Job in Drug Landing in 2019 National Health Insurance Negotiations "(Medical Insurance Fa [2019] No. 73). 97 drugs that entered the health insurance catalogue through price negotiations quickly entered the landing implementation stage, of which 70 were newly added varieties. The average drop in this round of negotiations was 60.7, 27 were renewed varieties, with a price reduction of 26.4 and a payment period of two years.

The varieties included in the medical insurance negotiation catalogue have a good opportunity for market development through price concessions, especially in market access, the provision of medical institutions, the application of clinical prescriptions, patient payment and other aspects, so as to occupy the first-mover advantage in an all-round way. In the first quarter of 2020, under the impact of the epidemic, the 89 health insurance negotiation varieties in the implementation period still maintained the momentum of rapid growth, with sales volume increasing by 23.30 percent year-on-year and sales volume increasing by 122.44 percent year-on-year, ushering in a good opportunity for market development through price-for-volume. Compared with the first quarter of 2019, the growth rate of sales amount of 65 of the 89 varieties showed varying degrees of increase, but the growth rate of 24 varieties still declined to varying degrees, the vast majority of which were injectable varieties, mainly affected by the epidemic.

Table of growth in various types of health insurance negotiation varieties in the implementation phase of public hospitals in key provinces and cities in China in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

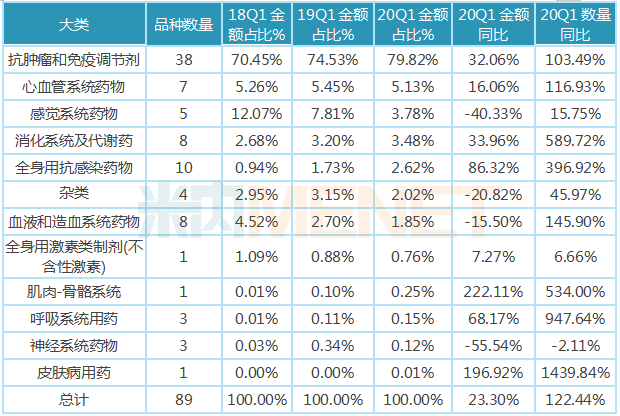

Cancer is a major disease that seriously threatens human survival and health, and the price of antineoplastic drugs is relatively high, and the high cost of treatment makes it difficult for most cancer patients to bear. As a result, the social phenomenon of "poverty due to illness" and "return to poverty due to illness" is also more common. Anti-tumor drugs are included in medical insurance, and drug prices are reduced through national negotiations, so that expensive life-saving drugs can enter the homes of ordinary people, it not only improves the accessibility of antineoplastic drugs, but also reduces the economic burden of cancer patients. Of the 89 health insurance negotiation varieties in the implementation period in the first quarter of 2020, 38 varieties are anti-tumor drugs, mainly monoclonal antibodies and tinib innovative drugs, accounting for nearly 80% of the total sales amount, up 32.06 percent year-on-year in the first quarter of 2019, and the total sales volume increased 103.49 percent year-on-year. The number of other types of health care negotiations is relatively small.

Table of distribution and growth of major categories of health insurance negotiation varieties in key provinces and cities in China in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

Under the double impact of the epidemic policy, different types of varieties are affected to varying degrees.

1. Acute and severe medication and drugs closely related to the use of new crown treatment are relatively less affected.

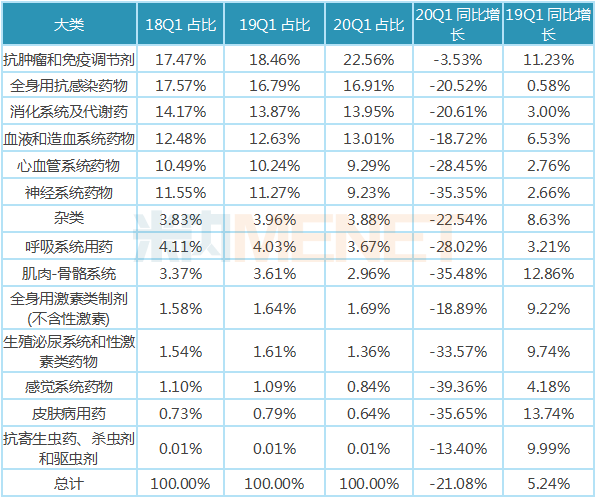

From the distribution of each category, compared with the first quarter of 2019, the proportion of sales amount of acute and severe drugs (such as anti-tumor immunomodulatory drugs) and antiviral drugs, antibacterial drugs, blood products and other categories closely related to the new crown treatment drugs have increased to some extent. Although the sales of these categories of drugs were negative in the first quarter of 2020 compared to the first quarter of 2019, they were higher than the growth of the entire chemical drug. The categories in which the proportion of sales decreased were mainly chronic drugs such as cardiovascular drugs, nervous system drugs and musculoskeletal drugs, as well as non-emergency drugs such as sensory system drugs and skin drugs.

Table of the proportion and growth of each category of chemical drugs in public hospitals in key provinces and cities in China in the first quarter of 2020.

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

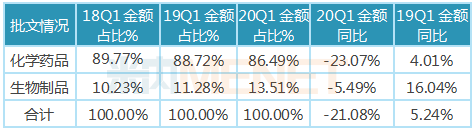

2, biological products are significantly less affected than chemicals.

According to the data of the intranet, in the first quarter of 2020, there were 277 varieties of biological products monitored in the databases of public hospitals in key provinces and cities, involving 541 brands; there were about 3500 kinds of chemical drugs, involving more than 6000 brands; because biological products were mainly innovative drugs, the number of varieties was relatively small compared with chemical drugs, and the market share in the market was relatively small, but it showed an upward trend year by year. The growth rate of sales amount of biological products in the first quarter of 2020 was -5.49, which was significantly higher than that of chemical drugs. There are two main reasons for this. One is that the newly listed varieties are mainly biological products, and 21 new biological products were added in the first quarter of 2020, including 13 monoclonal antibody varieties. On the other hand, there are relatively more anti-epidemic varieties (such as interferon, immunoglobulin in blood products, etc.) and heavy anti-tumor varieties in biological products, its market demand is large, the use of drugs is relatively large.

Table of the percentage and growth of chemicals and biological products in public hospitals in key provinces and cities in China in the first quarter of 2020

Note: The data source is the competitive pattern of public hospitals in key provinces and cities of the network, and biological drugs are also known as macromolecular drugs, and biological products are mainly divided into therapeutic biological drugs and preventive biological drugs. Prophylactic biological drugs mainly refer to vaccines, while therapeutic biological drugs mainly include monoclonal antibodies, enzymes, interferons, cytokines and insulin.

Immunoglobulins in biological products can identify various pathogenic bacteria that enter the human body and combine with them to make them lose their pathogenic ability to the human body and thus improve the body's immunity. In the absence of specific drugs, vaccines also take a long time to develop successfully, the prevention and treatment of new coronary pneumonia mainly rely on self-immunity, which has led to a significant increase in the demand for immunoglobulins, many of which are listed as therapeutic drugs. In the first quarter of 2020, intravenous human immunoglobulin (pH4) achieved sales of 0.512 billion billion yuan in public hospitals in key provinces and cities, up 41.34 year-on-year.

3. Imported approved drugs are significantly less affected than domestically approved drugs

In the first quarter of 2020, domestic approval varieties accounted for 66.97 of the chemical drug market in public hospitals in more than 20 key provinces and cities in China. Affected by the national policies of centralized procurement, key monitoring of rational drug use and medical insurance negotiation, the proportion of domestic approval varieties showed a downward trend year by year. The growth rate of imported drugs approved was significantly higher than that of domestic drugs approved, and the proportion increased year by year, reaching 33.3 in the first quarter of 2020.

Table of the percentage and growth of imports and domestic approvals for public hospitals in China's key provinces and cities in the first quarter of 2020

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

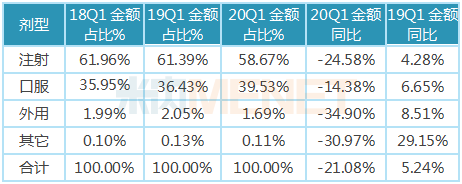

4, oral drugs are significantly less affected than injections, external use and other routes of drug use.

In the first quarter of 2020, injectable drugs were still the dominant dosage form in medical institutions, but affected by the epidemic, the number of patients and inpatients in medical institutions was greatly reduced, resulting in a certain degree of reduction in the use of injectable drugs in medical institutions. Compared with the first quarter of 2019, the growth rate of sales of injectable drugs was -24.56; the varieties of external use and other drug use routes were also relatively affected by the epidemic, the growth rate of sales in the first quarter of 2020 reached more than-30%.

Oral drugs play an important role in medical institutions. During the epidemic period, in order to ensure the drug demand of patients with chronic diseases during the new crown epidemic period and reduce the risk of cross-infection in offline treatment, the National Medical Security Administration issued the Notice on Optimizing Medical Security Agency Services to Promote the Prevention and Control of Pneumonia Epidemic Infected by Novel Coronavirus in February, which clearly stated that "actively support the 'long prescription' and realize the 'convenience of the country ', support medical institutions to reasonably increase the amount of drugs used in a single prescription according to the actual situation of patients, and reduce the number of times patients go to medical institutions for medical treatment and dispensing; for patients with chronic diseases such as hypertension and diabetes, after evaluation by the doctors of the diagnosis and treatment hospital, support the relaxation of the prescription dosage to 3 Months to ensure the long-term medication needs of insured patients". Oral drugs have the characteristics of easy to carry, in the strengths of the side to occupy a certain advantage, so the sales amount of such drugs in the first quarter of 2020 year-on-year growth rate of -14.38, significantly higher than the growth rate of other dosage forms, the impact of the epidemic is relatively small.

Table of the proportion and growth of the amount of each route of drug use in public hospitals in key provinces and cities in China in the first quarter of 2020.

Note: Data source: The competition pattern of public hospitals in key provinces and cities of the network.

Conclusion

In the first quarter of 2020, affected by the epidemic and policies, the amount of drug use in China's medical institutions has been greatly impacted, with the control of the epidemic, people's lives and work gradually return to normal, factories resume work and production, hospitals gradually increase the number of patients, the second quarter of medical institutions will gradually return to normal, the impact of the epidemic significantly reduced. In the long run, under the influence of consistency evaluation and normalization of procurement with quantity, the prices of generic drugs and original research drugs that have passed the patent period are further under pressure, and the market share of low-quality drugs and key monitoring catalog drugs with low clinical value is accelerating Decline, and more space will be left for innovative drugs. Driven by a series of policies to encourage innovation, companies continue to develop innovative drugs with high clinical value through innovation transformation, in order to be in an invincible position in the fierce market competition. Therefore, it can be said that the epidemic will not change the long-term trend of the pharmaceutical industry, but will accelerate the elimination of backward production capacity, innovation-driven is still the general direction of the development of the pharmaceutical industry.

Data source description: The data in this report are from the competition pattern of chemical medicine terminals in public hospitals in key provinces and cities in the Milineiet. The database covers 20 provinces and cities (including Beijing, Inner Mongolia Autonomous Region, Heilongjiang Province, Jilin Province, Liaoning Province, Tianjin City, Hebei Province, Guangdong Province, Henan Province, Chongqing City, Hubei Province, Hunan Province, Shanghai City, Shandong Province, Anhui Province, Zhejiang Province, Jiangsu Province, Sichuan Province, Shaanxi Province, Yunnan Province, Xinjiang Uygur Autonomous Region, etc.), nearly 700 sample provincial and municipal public hospitals. The sample data covers 14 categories, 90 subcategories, and a total of 4800 generic varieties. The drug use structure of medical institutions can be analyzed from multiple perspectives and dimensions such as categories, subcategories, varieties, brands, dosage forms, specifications, manufacturers, and years and quarters. The quarterly update of data can timely reflect the impact of various policies on the use of drugs in medical institutions.